Revenue – Expenses = Job Profitability

That’s easy. What is not so easy to defining 1) Revenue and 2) Expenses. Don’t ask your accountant to explain it – They will all have different answers and most will get it wrong anyway. Let’s ask ServiceM8 to demonstrate the calculation of Job Profitability. Why – because ServiceM8 has nailed it – their calculation is simple, easy, avoids complex accounting theory, timely, and totally understandable most tradesmen.

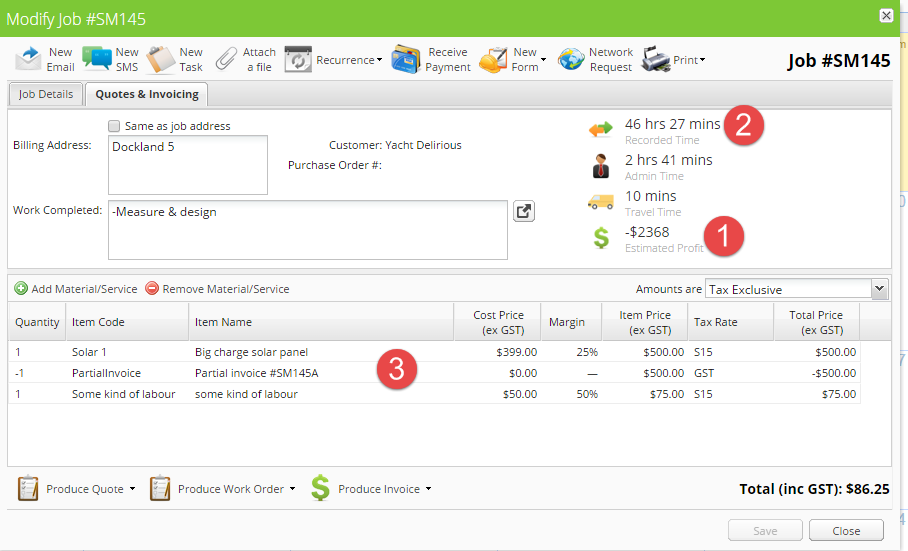

Just open the job and the number will jump out at you. This visibility is of course controlled by security settings.

- Houston – We have a problem – we’ve got a looser !

- 46 hours 27 minutes of work … 2 hours 41 minutes of admin time, and 10 minutes to get to the job – No wonder we’re loosing.

- Some of the ‘stuff’ we’ve used on the job.

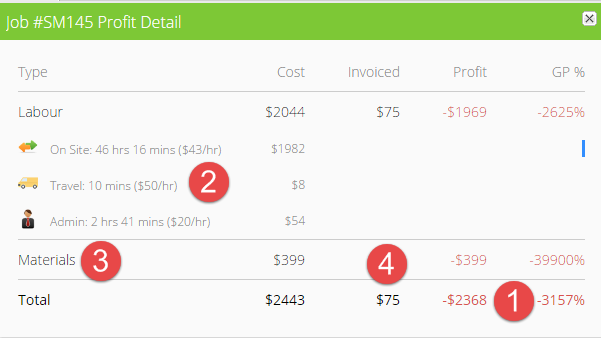

Why are we projecting a loss on this job ? Double click on the number and we’ll tell you:

- There’s the ugly red number again – now appearing with the supporting detail

- Labour has ‘Cost’ us a total of $2,044. Did we pay that to someone ? Is that net, gross or an accounting. It’s what you defined as your cost of labour. You set the hourly ‘costs’ purely for calculating these displayed profitability numbers. They won’t be going to your accounting system so we can avoid telling the accountant – but this is a reality – You “know’ that although you pay your technician $37.50 per hour – he’s really costing you about $43/hour to have on the job. So use reality !

- Materials costs. Is that Average cost, FIFO, First, Landed ….. It’s whatever you know once again. Each item can be set to user defined ‘cost’ to factor in whatever you want to factor in. Again, this is not updating your accounting system – but then this ‘soft’ cost can actually be maintained in the your linked accounting system.

- Invoiced. This value represents the amounts which are schedule to be invoiced to the customer – Specifically – “Some kind of labour” in the previous screenshot.

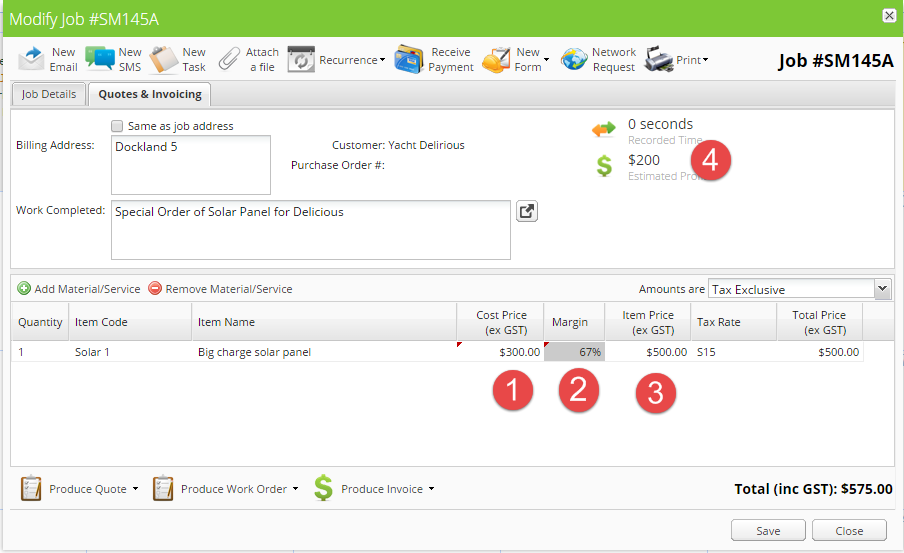

Margin Analysis

Also now available is line item margin analysis

- Item cost – Again – not as defined by the accountants – It what is generally referred to as “standard cost” or to the tradesman – whatever you enter.

- Margin is the reported as a percentage representing Sell-Cost/Cost.

- Price is the selling price or revenue

- Estimated profit represents the entire anticipated job profitability as described above – Shown again here as the calculation is very easy to see (500 – 300 = 200)

Magical efficiency occurs when you need to use a sharp pencil – Change 1, 2 or 3 and the other two number will be recalculated – instantly – automatically.